Earlier I went outside and started cutting the grass, stopped about half way through decided I reaaaally needed a haircut, and some time to check out the OCL 5.56 Plutonium can. Went to the local dealer here, he had it in stock . I fondled it for quite a bit of time. Told them to set me one aside I'll be by Monday with the cash less the sales tax so it will be in lay away.

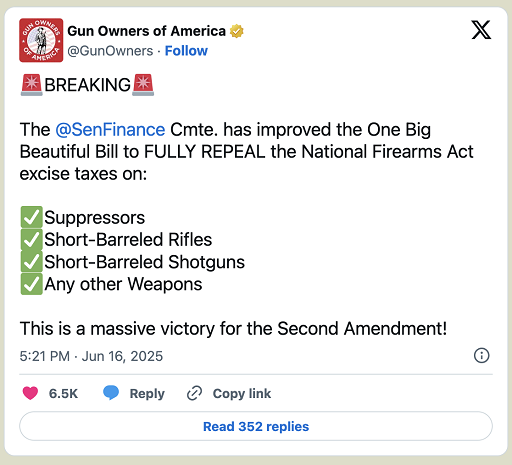

While there the Bill passed, which sparked a discussion on the effective date, which the shop thought it was to go into effect. Naturally I spouted off with what I understand of the effective date would be 1 Jan 2025 provided the President signs prior to the last two days in September.

But stated heck I could be wrong come back home pulled up the text of the bill. Yep there is a effective date and what I though to be true was.

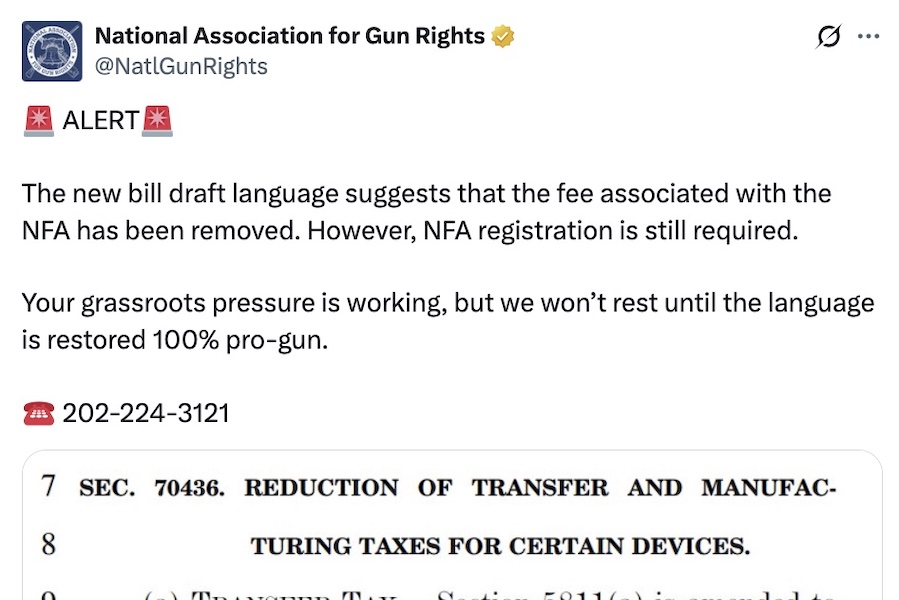

As I was carefully reading the bill I realized I am wrong earlier that this bill removed the tax status, on the items.

This silly line is what gets me

" (c) Conforming Amendment.--Section 4182(a) is amended by adding at

the end the following: ``For purposes of the preceding sentence, any

firearm described in section 5811(a)(2) shall be deemed to be a firearm

on

which the tax provided by section 5811 has been paid. ''

I'm neither Lawyer, tax expert, nor CPA. But to my silly third grade education. A argument that it is not taxed could be null and void in court.

But the Line above that cut and paste is:

"

(a) Transfer Tax.--Section 5811(a) is amended to read as follows:

``(a) Rate.--There shall be levied, collected, and paid on firearms

transferred a tax at the rate of--

``(1) $200 for each firearm transferred in the case of a

machinegun or a destructive device, and

``(2) $0 for any firearm transferred which is not described

in paragraph (1).''.

(b) Making Tax.--Section 5821(a) is amended to read as follows:

``(a) Rate.--There shall be levied, collected, and paid upon the

making of a firearm a tax at the rate of--

``(1) $200 for each firearm made in the case of a

machinegun or a destructive device, and

``(2) $0 for any firearm made which is not described in

paragraph (1).''.

."

so I don't know now I did have a opinion earlier, now not so sure. Would be nice if it could be challenged I could see this going either way.

Source

https://www.congress.gov/bill/119th-congress/house-bill/1/text

SECTION 70436

In closing I do know that the ATTORNEY GENERAL does have the authority to wave the tax. Just like was done during the Pistol Brace SBR rule. So Pam Bondi "could" give us a small Christmas present early by waving the tax until the effective date.

Like the saying goes "can't kiss no movie stars without asking".

www.breitbart.com

www.breitbart.com